Vice President of IMANI Ghana, Bright Simons, has revealed that three groups representing individual bondholders have commenced mobilisation to file legal suits against the government for including individual bondholders in the Debt Exchange Programme.

According to him, one of such groups is led by a former boss of the Securities and Exchange Commission (SEC).

The Finance Ministry had earlier cautioned individual holders of eligible bonds who refuse to take the Amended and Restated Exchange Memorandum under the Debt Exchange Programme provided by the State that they will find it difficult to obtain a judgement against the Government of Ghana.

Under a caption labelled “Enforcement of Civil Liabilities” in the 58 page Amended and Restated Exchange Memorandum to individual bondholders, Finance Minister, Ken Ofori-Atta emphasised that since Ghana is a sovereign state, any legal action taken by bondholders against the country would be difficult to materialise.

“The Republic of Ghana is a sovereign state. Consequently, it may be difficult for Eligible Holders of Eligible Bonds to obtain or realise awards against the Republic”.

“The Republic has submitted to the jurisdiction of the courts of Ghana and waived any immunity from the jurisdiction (including sovereign immunity) of such courts in connection with any action arising out of or based upon the Invitation to Exchange or any securities issued under the Invitation to Exchange brought by any holder of such securities,” it added.

But in a tweet, Mr. Simons said “it was anticipated that adding individual/retail investors to Ghana’s debt default will increase the risk of litigation. At least 3 groups representing individual bondholders have commenced mobilisation to file class action lawsuits. One group is led by a former SEC boss.”

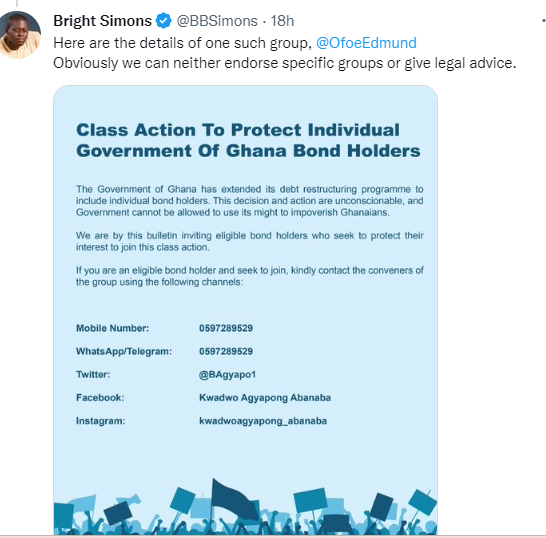

“Here are the details of one such group, @OfoeEdmund. Obviously we can neither endorse specific groups or give legal advice”, he added.

The Finance Minister on December 5, 2022 announced a Domestic Debt Exchange programme to restructure the country’s debt which had reached unsustainable levels.

It initially excluded individual bondholders, but after stiff opposition from labour which led to their exclusion, government included retail bondholders.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

![Business tycoon in Novrongo to bury late father in a car [Video]](https://ghananewss.com/storage/2023/05/business-tycoon-100x75.jpeg)