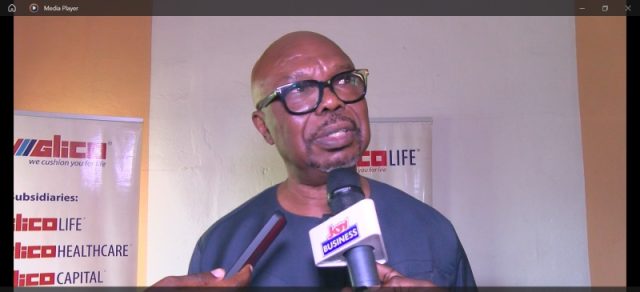

Chief Sales Officer for Glico Life Insurance, John Ekar Smart has indicated that more collaboration with stakeholders within the sector is key to boost insurance coverage in Ghana.

According to him, more effort should be put into various sensitization programmes to strengthen and streamline the activities of the sector.

Mr. Smart spoke at a ceremony organised to show how Glico Life Insurance is committed to claim payment.

The company made claims payment of ¢15,000 to family of the late Military officer, Sherrif Imoro, a soldier who was recently murdered in Ashaiman in the Greater Accra region.

“We are here because it’s important for us to pay claims for people whose policies are with us. We need to start the education with you as a journalists. We need more of it. There is the need for us to also widen the scope of micro-insurance to include all other small and medium enterprises”.

“There is the need for conscious efforts to send insurance to the last mile, beyond the 18th mile from the commercial towns, district capitals, and regional capitals”, he added.

According to the National Insurance Commission (NIC), in developing countries like Luxembourg, with a GDP of more than US$70billion, insurance penetration as of 2017 was 38.8%.

It is however surprising that compared with the peers of these countries in Africa, South Africa has the highest level of insurance penetration (16.99%) followed by Namibia (6.69%) and Lesotho (4.76%) with Ghana hovering at around just 1% as of 2018.

Glico Life Ghana says it will contribute its quota to the growth of the insurance sector in Ghana.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Tags:

![Abiana unveils ‘Taste of Africa’ EP with mega concert [Video]](https://ghananewss.com/storage/2023/11/Abiana-concert-4-100x75.jpeg)