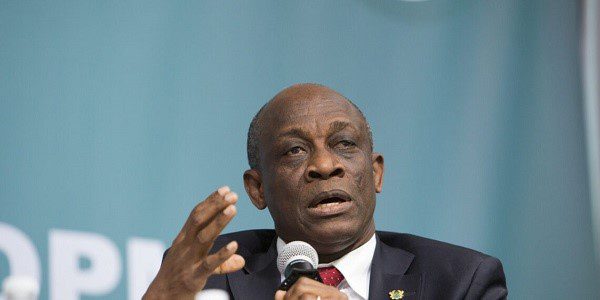

Former Finance Minister Seth Terkper has asked the flagbearer of the New Patriotic Party (NPP) Dr Mahamudu Bawumia if gold can improve forex reserves, how come the same government depleted oil-based Petroleum Revenue Management Act (PRMA) funds.

Dr Bawumia had promised to build Ghana’s gold reserves appreciably to reach a point when the country will have sufficient gold reserves to keep its external payments position sustainably strong.

This, along with a supportive fiscal discipline, will provide long-term stability for the exchange rate of the cedi and at the same time reduce our dependence on the

Eurobond markets, he said.

But in a post on his X platform reacting to this, Mr Terkper said “If Gold can improve forex reserves, how come same government depleted oil-based PRMA funds, Ghana Fund [Bal. of Stabilization & Heritage Funds], even with 3 fields. Recall, we wanted to use the Heritage Fund to finance FSHS in 2017-18? Consistency of policies matter.”

Dr Bawumia in his address on Wednesday February 7 said that a major factor influencing macroeconomic stability is the consistent depreciation of the cedi against foreign currencies.

This, he said, is usually caused by pressure on our foreign exchange reserves.

“Appreciably increasing our reserves of gold at the central bank combined with prudent fiscal policy, is therefore one of the surest ways to keep the exchange rate stable.

“Two policies that helped rescue the economy from catastrophe in the recent crisis were the Bank of Ghana’s domestic gold purchase program and the gold for oil program.

The domestic gold purchase program (DGPP) is a program where the Bank of Ghana boosts its foreign exchange reserves by buying locally produced gold with cedis. Before this program, the total gold reserves of Ghana since independence was 8.7 tons. This compares to 3,352 tons for Germany, 2,814 tons for the IMF, 2,451 tons for Italy, and 8,133 tons for the United States. It did not make sense to me that Ghana, the largest gold producer in Africa, will have some of the lowest holdings of gold reserves so I proposed to the Bank of Ghana to start a Gold Purchase Programme.

National service will no longer be mandatory when I come into office – Dr. Bawumia

“The Gold for oil program on the other hand allows the payment for oil imports with gold. So importers provide cedis which the Bank of Ghana uses to buy gold and pays the

suppliers of the oil. This reduces the pressure on Ghana’s foreign exchange reserves and stabilizes the exchange rate.

“The Bank of Ghana (BoG) has purchased 26 tonnes of gold (US$1.73 billion) since inception of the domestic gold purchase program under its gold for reserves policy. The government of Ghana’s Gold for Oil programme which started in late December of 2022 has purchased 16 tonnes of gold (US$1.06 billion) that has been available for the import of petroleum products.

“Together, the gold for reserves and gold for oil programmes have unlocked US$2.79 billion to meet external payments of the country in just over a year. These two policies have allowed us to build foreign exchange reserves, pay for critical imports like fuel, and stabilize the exchange rate. It is important to note that the $2.79 billion unlocked is almost equivalent to the $3 billion loan we have obtained from the International Monetary Fund to

be disbursed over three years! What is clear to me is that if we had started implementing these policies say 20 years ago, Ghana would be in a very different situation today.

“However, given the large amount of gold reserves Ghana has, this is just the tip of the iceberg. Ghana has seven large gold belts stretching from Axim and Winneba to Nangodi and Lawra. According to the Geological Survey Department, the belts cover an area of 43,000 square kilometres, with about 50% (21,000 km) not explored yet,” he said.

He added “The conservative estimate is that the potential quantum of gold in these unexplored belts is around 5 billion ounces. This has a market value today of $10 trillion dollars. My government will engage exploration experts from the universities and geological Institutions to assist in exploring our seven gold belts. However, even if only 5% of this 5 billion ounce estimate materializes, it will be a game changer for Ghana.

“Our policy will be to build Ghana’s gold reserves appreciably to reach a point when we have sufficient gold reserves to keep our external payments position sustainably strong. This, along with a supportive fiscal discipline, will provide long-term stability for the exchange rate of the cedi and at the same time reduce our dependence on the

Eurobond markets,” he said.

![“It’s hard to say goodbye” – Christian Atsu’s wife composes emotional tribute song for him [Video]](https://ghananewss.com/storage/2023/05/Christian-atsu-and-wife-100x75.jpeg)