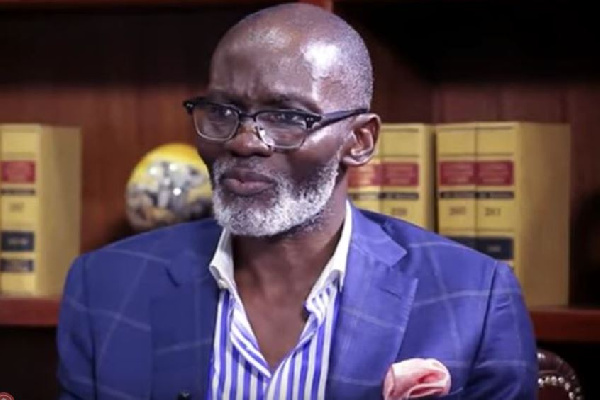

Founder of Danquah Institute and member of the New Patriotic Party (NPP), Gabby Otchere-Darko

Private legal practitioner, Gabby Otchere-Darko, has indicated that the refusal by individual bondholders to accept government’s debt exchange programme will worsen the country’s economic crisis.

According to the NPP stalwart, the widespread rejection by the bondholders will not augur well for the country, hence the need for them to soften their stance.

In a series of tweets on Sunday evening, he explained that even though the terms of the debt exchange programme will affect individual bondholders, it is a necessary step which must be taken to salvage the economy.

He said if the bondholders fail to cooperate with government, their bonds may be affected in the future in addition to a further deterioration of the economy.

“Ghana is in a very difficult place. What we are seeing with the mobilisation of agitation on individual bondholders poses a real and serious risk worse than what we witnessed when opposition to E-Levy succeeded in derailing an already shaky macroeconomic situation from 2021”, portions of his tweets read.

“The debt exchange programme is voluntary for individual bondholders but a very necessary evil for our economy.

Its success is critical to restoring macroeconomic stability, securing an IMF prog. It hits those of us holding bonds very hard. A straight no to it is no solution!”, Mr Otchere-Darko stressed.

“If the no-compromise opposition to it wins, what then has been achieved? It may lead to national debt default.

So what then happens to the value of your bonds after! Potentially worthless. If participation is low, we jeopardize resolving the economic crisis and hardships”, he wrote.

In concluding his comments on the matter, he said, “I’m sorry but we have to face the hard/painful truths. We ain’t sitting pretty.

Our focus must be on how the burden to individual bondholders may be possibly eased; but not to take the hardline position of simply saying no to particpation. It will come back to hit us harder!”.

While noting the possible dangers if the programme does not go through, he called on individual bondholders to rally behind government to help restore the economy.

The remarks by the founder of the Danquah Institute comes in the wake of growing public agitations from individual bondholders about government’s proposed domestic debt exchange programme.

In a bid to rescue the economy and secure a deal with the International Monetary Fund (IMF), government has proposed that all bondholders will not receive any interests on their bonds for the 2023 financial year.

The payment of dividends, according to government is likley to begin next year, 2024 at a discounted rate of 5%.

In relation to this, bondholders who may want to transfer or even forfeit their bonds will not even be able to get the full principal they initially invested as bonds.

This proposal, since its announcement has been rejected by many bondholders who have subsequently expressed frustration about the development.

In their view, if the proposal is implemented, they will suffer a great deal of loss, with many of them stating that their investments may even become unprofitable.

Some of the aggrieved bondholders, who recently interacted with JoyNews have thrown their hands in despair, with others contemplating suicide.

The affected investors say with government’s intended management of their bonds, they may not even be able to meet their expenses such as rent, feeding and the payment of fees for their wards.

They have therefore called on government and other relevant stakeholders to intervene in the matter.

In this regard, policy analyst, Senyo Hosi, who is part of the crusade is currently mobilising all affected bondholders to collectively resist the move by government.

Speaking on JoyNews‘ PM Express last week, he stated that the proposal by government is ‘insensitive’ and must be outrightly resisted.

Meanwhile, government insists the debt exchange programme is the way to go in rescuing the economy.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

![“It’s hard to say goodbye” – Christian Atsu’s wife composes emotional tribute song for him [Video]](https://ghananewss.com/storage/2023/05/Christian-atsu-and-wife-100x75.jpeg)